unable to find the category in the db table

unable to get the parent.

Energy Deregulation - What is it and Why is it Happening?

Founder and President, SilentSherpa ECPS

Posted 8/22/2006 4:06:45 PM

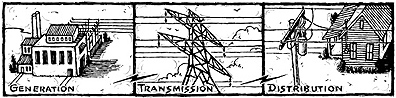

Energy utility services and costs are comprised of three primary elements: 1. [Supply] Generation (power plant and fuel costs such as coal, oil, natural gas, nuclear, renewable, etc.), 2. Interstate Transmission (high voltage power lines that run across state lines to substations), and 3. Intrastate “Local” Distribution (lower voltage power lines that run within a utility’s distribution territory to your business or home).

Energy Deregulation, or “Energy Restructuring” as it is often referred to in legislative arenas, affords the energy consumer the ability to purchase the [Supply] Generation component of their utility service from a third-party competitive supplier…while the Transmission and Distribution (“T&D”) charges remain monopolized by the local utility and regulated by a state public utility commission. Although Generation is one of three cost components, it generally accounts for the majority of the consumers total billed cost (i.e. 50% - 60% of utility billed cost). Restructuring laws are passed and administered on a state-by-state basis. Hence, each state may have different procedures, timelines and levels of utility participation governing their respective energy market(s). The one commonality of restructuring legislation is that it requires an investor owned utility to divest its generation capacity (i.e. sell off its power plants to non-regulated power producers). The primary purpose of this activity is to establish free market competition at the wholesale and retail levels, such that the laws of supply and demand rule the investment and sales of energy generation rather than federal or state regulation…hence, “Energy Deregulation.” In doing so, investor owned utilities must purchase or “buy back” the energy supply the utilities once generated themselves for sale to their rate payers at a “market based” rate. The purchase and sale of this power is also open to non-regulated businesses which are free to market their own “brand” of energy to the utility’s customer base. These non-regulated businesses are commonly referred to as “Energy Marketers” and/or “Competitive Suppliers”. So why would an investor-owned utility be willing to give up a monopoly on energy supply generation? The answer is quite simple, although it may not be what you think: investor-owned utilities are prohibited by law from making a profit on energy generation…rather they are afforded a guaranteed Return On Investment (ROI) on their Transmission and Distribution capital, operations and maintenance. Hence, the utilities now have the opportunity to reduce a large amount of overhead, expense, and cash flow “headaches” and still yield the same cash profit which translates into an increased ROI for their shareholders (i.e. same profit allocated over lower operations cost). No, deregulation is not necessarily about saving the consumer money. Although the laws require consumers now have choice via competition among supply generators and sellers, deregulation does not guarantee the consumer will choose the most economic alternative…that’s up to you! |